Medicare Supplements

What you need to know

Medicare Supplements

What you need to know

What’s Medigap?

The term Medicare Supplement and Medigap are used interchangeably in the insurance industry. Medicare Supplement (Medigap) is an extra insurance policy sold by private insurance companies to cover what Original Medicare leaves you to pay, such as, co-pays, co-insurance and deductibles.

If you have a Medicare Supplement (Medigap) policy and receive care from a hospital or doctor’s office, Original Medicare will pay its share of the approved amounts and your Medigap policy will pay its share. You will pay a private insurance company a premium for your Medicare supplement in addition to your monthly Part B premium.

What policies are available?

Medicare supplement policies that are sold to consumers must follow federal and state laws that are designed to protect the consumer. When choosing a Medicare Supplement policy it should be clearly identified as “Medicare Supplement Insurance” and insurance companies can only sell you standardized Medicare supplement policies identified in most states by letters A-D , F,G K-N. In Massachusetts, Minnesota, and Wisconsin, Medicare Supplements are standardized in different ways. Please click here for more information.

A few things to know

When purchasing a Medicare Supplement plan they are all standardized, which means that no matter which insurance company you purchase the Medicare supplement plan from, the plan will have the same basic benefits. For example, a Plan G purchased from United Health Care in Michigan will have the same benefits that a Plan G purchased in Florida from Humana.

Some States also offer what’s called a Medicare Select Plan. These are also standardized plans, but they require you to use hospitals and, in some cases doctors within a network to be eligible for full benefits (except in an emergency).

Since January 1, 2020 people new to Medicare will no longer be able to purchase a Medicare supplement plan that covers the Part B deductible. This was due to a law that was passed by Congress in 2015 called Medicare Access and Chip Reauthorization Act of 2015 (MACRA). If you are new to Medicare on or after January 1, 2020 plans C and F will not be available. If you were on Medicare prior to January 1, 2020 and had a plan C or F you can still keep your plan or switch to another plan C or F to save money. (You will have to go through medical underwriting from the insurance carrier and each insurance carrier has different underwriting)

When’s the best time to buy a Medicare Supplement policy?

Generally, the best time to purchase a Medicare Supplement policy is during your Open Enrollment Period when you have a guaranteed right to buy a policy in your state. This 6-month period starts the first month you have Medicare Part B and you’re 65 or older. Some states have additional Open Enrollment periods, including for those people under the age of 65. You can check with your State Insurance Department to learn more about rights you might have under state law.

How do I compare Medicare Supplement Plans?

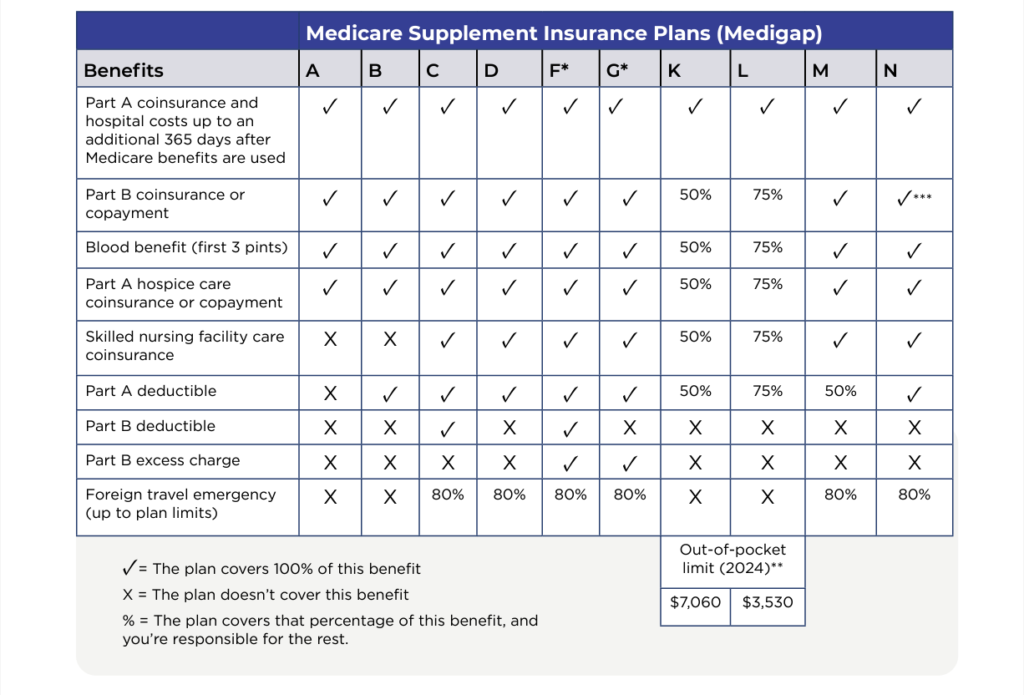

* Plans F and G offer a high-deductible plan in some states (Plan F isn’t available to people new to Medicare on or after January 1, 2020). If you get the high-deductible option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,800 in 2024 before your policy pays anything, and you must also pay a separate deductible ($250 per year) for foreign travel emergency care.

**For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible ($240 in 2024), the Medigap plan pays 100% of covered services for the rest of the calendar year.

*** Plan N pays 100% of the costs of Part B services, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in an inpatient admission.

Click here to download the Medicare Supplement Plans PDF.