Medicare Advantage

What you need to know

Medicare Advantage

What you need to know

Medicare Advantage also known as “Part C”

These are Medicare approved plans from private insurance companies. When you join a Medicare Advantage plan you are allowing a private insurance company to manage your Medicare Part A and Part B. Medicare Advantage plans usually include Medicare Part D. Plans may also offer some extra benefits, such as, hearing, dental

and vision benefits.

Your decision between choosing a Medicare Supplement plan and a Medicare Advantage plan may affect how you pay for coverage, what services you get and what doctors you can see.

Medicare Advantage

- You must have Medicare Part A and Part B

- In many cases, you can only use doctors who are in the plan’s network.

- In many cases you may need to get approval from your plan before it covers certain drugs or services.

- Medicare Advantage plans are not all created equal. Plans that private insurance companies offer may vary in out of pocket cost and services.

- Medicare Advantage plans may offer some extra benefits that Original Medicare doesn’t.

- Most Medicare Advantage plans offer Medicare Part D.

Medicare Part D

What Will Medicare Part D Cost Sharing Look Like in 2025?

Starting January 1, 2025, the Medicare Part D coverage gap—commonly referred to as the “donut hole”—will no longer exist. This significant update, brought about by the Inflation Reduction Act, simplifies prescription drug coverage and introduces a $2,000 annual cap on out-of-pocket expenses for covered medications.

The following phases outline how out-of-pocket costs are managed under Part D throughout the year:

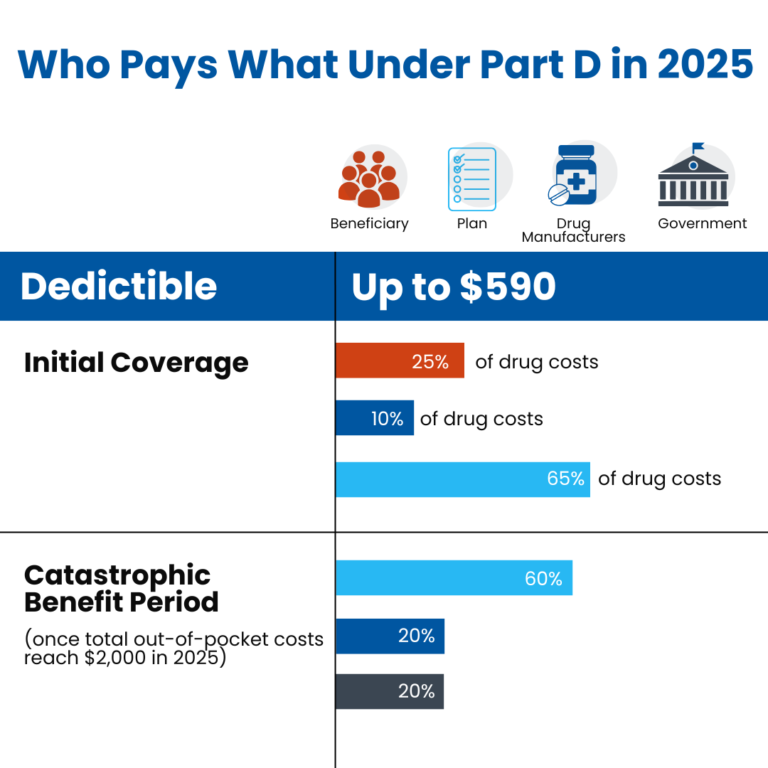

♦ Deductible Phase: During this initial stage, beneficiaries are responsible for paying 100% of their prescription drug costs until they meet the deductible amount. For 2025, the standard deductible is set at $590. However, certain plans may feature a lower or even zero-dollar deductible paired with a higher premium. Once the deductible is satisfied, beneficiaries move into the initial coverage phase.

♦ Initial Coverage Phase: In this stage, beneficiaries are required to cover 25% of their prescription drug expenses, typically through coinsurance or copayments. The Part D plan contributes 65% of the costs, and drug manufacturers account for the remaining 10%. Out-of-pocket spending, including deductibles, copayments, and coinsurance, is capped at $2,000 for 2025. Upon reaching this limit, beneficiaries transition to catastrophic coverage.

♦ Catastrophic Coverage Phase: At this level, the Part D plan covers 60% of drug costs, the manufacturer covers 20%, and Medicare handles the remaining 20%. Beneficiaries are no longer responsible for any additional payments for covered prescriptions for the rest of the year.

For a clearer understanding, our infographic below illustrates the cost-sharing responsibilities within the different phases of Medicare Part D coverage in 2025.